Paraguay’s Business Infrastructure

Paraguay provides excellent conditions in order to attract and retain investors from all over the world. It has a stable democratic government and private property rights are respected in the constitution.

Foreign and local investors are treated equally, i.e. there is no limitation to ownership by foreign buyers, no currency exchange controls or forced conversion into local money. This means that any currency can be used for transferring money within or out of the country, e.g. Dollars or Euros.

The transportation infrastructure is robust, including ports and roads.

The tax environment is highly attractive:

- 10% Corporate Tax

- 15% Withholding Tax (investors domiciled abroad)

- 10% Personal Income Tax

- 10% Value Added Tax

- 0% Export Tax

- 0% Capital Gains Tax

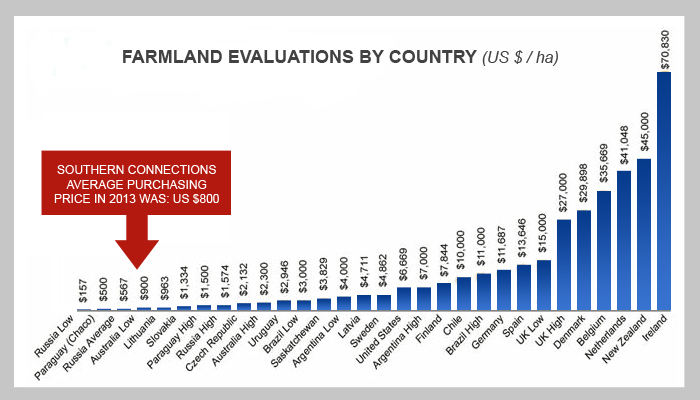

Paraguayan farms adhere to good sanitary standards and are foot and mouth disease free again. Land prices for comparable farming terrain are 4x less than in Uruguay, and 2x less than in Argentina.